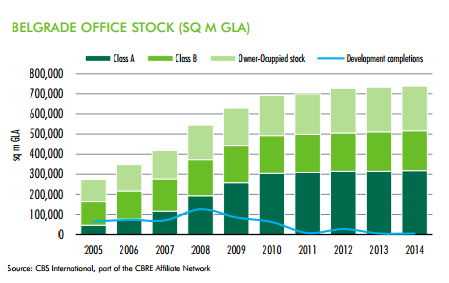

BELGRADE OFFICE STOCK

At the end of 2014, the total Class A and Class B office stock in Belgrade remained at the same level, exceeding 738,000 of GLA, out of which 70% is speculative, i.e. 516,000 sq m and 30% owner occupied space, or 221,000 sqm. During 2014, only two small-scale projects were completed, generating the increase of the total stock of 5,000 sq m in total.

The reputable developer GTC intensively continued the construction works on its project GTC 41, located in New Belgrade, totalling 9,870 sq m of GLA. The completion of this phase of the project, which will encompass 27,000 sq m, is expected in Q3 2015.

Societe Generale Bank commenced the construction works on its new headquarters building of 10,000 sq m, located in Zorana Djindjica Boulevard, New Belgrade.

Several other smaller-scale projects are also in various construction phases, proving that the market is in demand of new office space. The local investor Granit Invest, started preparation works for new office scheme, located in city center, municipality Vracar. This small-scale office building will have 5,000 of GBA and about 2,000 sq m GLA of modern office space. This project will enlarge supply in the city center in 2015.

The further development of New Belgrade will be supported by planned expansion of the first Belgrade Business Park of 70,000 sq m of GLA, Airport City Belgrade. Israeli AFI Group and Tidhar aim to expand the complex, with 4 new office buildings, while the first building should comprise 12,000 sq m.

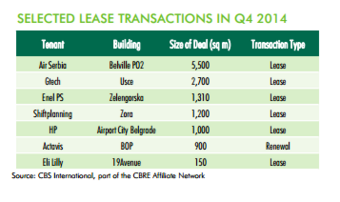

DEMAND (TAKE-UP)

The last quarter recorded the strongest take-up in 2014, being more than doubled as compared to the corresponding quarter of the previous year, standing at the level of 20,108 sq m, i.e. 29 transactions with average deal size of 693 sq m. Analysing by the sector of the business, IT companies were the key performer, followed by Public companies, Consumer Goods sector and Manufacturing sector.

The total leasing activity in 2014 exceeded 63,000 sq m, recording an increase of app. 5%, as compared to 2013-results.

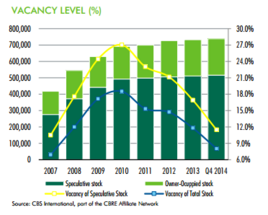

VACANCY

Due to the strong absorption on new space in Q4 2014, the overall vacancy rate on the market further dropped to nearly 8%. Compared only to the speculative (leasable) stock, vacancy rate also noted a decline, reaching the level of 11.5%.

RENTAL LEVELS

The constant downward trend in the vacancy levels along with the stable demand shifted the market, becoming more landlord-oriented, allowing landlords to reconsider the upward corrections in the rental levels.

At the moment, the headline rental levels for Class A office buildings slightly rose to the level of EUR 15-17/sqm/month, while the average rents of Class B premises range between EUR 11-12/sq m/month. Prime yields vary between 9-9.5%.

Source: CBRE Serbia